The Death of Your TOFU Content

HubSpot had one of the best SEO teams in the world. They lost 70-80% of traffic in weeks. If you're still building content the same way you were two years ago, you already know how this ends.

We need to tell you about what happened four days ago.

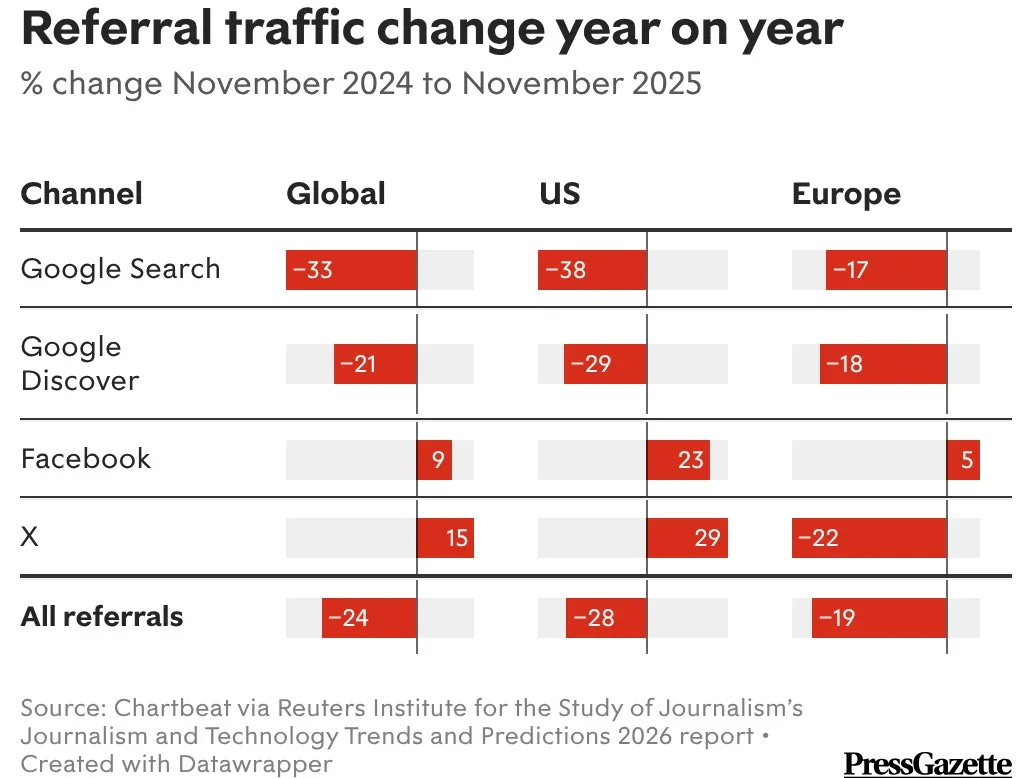

The Reuters Institute published their 2026 trends report. They surveyed 280 media leaders from 51 countries in November and December. Google search traffic to publishers fell 33% globally in the year ending November 2025. In the US? 38%.

But here’s the part that made me sit up: Publishers expect another 43% decline over the next three years. One in five said they expect to lose more than 75% of their search traffic. When asked about 2026 strategy, most said they’re putting less effort into traditional Google search.

Not pivoting. Not adapting. Less effort.

That’s not fear. That’s capitulation. The industry just admitted the old playbook is finished.

Business Insider cut 21% of staff after losing 55% of organic traffic. The New York Times watched search drop from 44% to 37% of their traffic. DMG Media (MailOnline, Metro) saw click-through rates fall up to 89% on certain searches.

The commodity TOFU factory isn’t closing. It’s already closed. The smoke is still clearing.

Picture This

You’re a publisher. You built your business on a simple bargain: produce good informational content, rank it, get clicks, make money. It worked for a decade.

Google rolled out AI Overviews in May 2024. By October, they showed up in over 42% of searches. When Pew Research tracked 68,000 real queries in July 2025, users clicked results 8% of the time when AI summaries appeared. Without AI summaries? 15%.

That’s a 46.7% drop in clicks. Not for bad content. Not for thin content. For any content that gets an AI Overview.

Zero-click searches went from 56% to 69% between May 2024 and May 2025. Think about that. Seven out of ten searches now end without anyone clicking anything.

Then December Hit

Google pushed a core update in December 2025. Publishers reported “catastrophic” losses. Some went from steady Discover traffic to zero overnight. Not “down 20%.” Zero. Traffic declines ranged from 12% to 100% depending on the site.

Chegg (the learning platform) saw a 49% decline in traffic between January 2024 and January 2025. They filed an antitrust lawsuit in February 2025 alleging Google trained AI on their content, then used that AI to compete with them directly.

Google’s response? They’re tightening spam policies. Explicitly targeting “scaled content abuse”. Massive volumes of pages created primarily to game rankings. When everyone can mass-produce TOFU with AI, Google either raises the bar or drowns in garbage.

They chose to raise the bar. Way up.

Two Things Are True At Once

Supply collapsed

It’s stupidly cheap to produce infinite “good enough” explanations now. AI-assisted writing is a major share of new publishing. The web isn’t saturated. It’s drowning.

Demand evaporated

Users don’t click anymore. They get synthesis in the AI Overview, they ask ChatGPT, they stop earlier because the answer feels complete. Although, Digiday reported in December 2025 that all AI platforms combined account for 1% of publisher traffic. ChatGPT sends 87.4% of that 1%. It’s not enough to offset Google losses. Not even close.

But you’re fighting on three fronts now:

Classic search

AI Overviews on Google

Chat interfaces (ChatGPT, Gemini, Perplexity)

And you can’t assume any of them will send clicks.

TOFU keywords behave like “answer endpoints” now. Some drive clicks. You just can’t bank on it.

So What Actually Survives?

Back to that Reuters report.

Original investigations and on-the-ground reporting ranked at the top. Service journalism and evergreen content? Least important.

That’s executives repositioning their entire operations based on data, not theory.

The shift isn’t TOFU to MOFU. It’s commodity TOFU to defensible TOFU.

Experience TOFU

First-hand tests. Before/after. Teardowns. “We tried it so you don’t have to.” Aligns with Google’s E-E-A-T framework on experience, but more importantly, it’s just hard to fake at scale with AI.

Data TOFU.

Original research. Benchmarks. Live indexes. You either did the study or you didn’t. Plus it’s the easiest thing for AI to cite. You win even when users don’t click.

Community TOFU.

Threads. Annotated case studies. Public teardowns. When your TOFU lives in community spaces, you’re not dependent on Google’s algorithm at all.

Tool TOFU.

This is where it gets interesting.

Research from Brixon Group in May 2025 found ROI calculators hit 65-78% completion rates. Conversion rates of 25-35%. Compare that to regular landing pages.

B2B decision-makers spend an average of 4 minutes 27 seconds on interactive calculators. More than three times typical dwell time on static content.

A marketing automation provider saw 218% higher conversion rates with AI-powered ROI calculators versus static content. A B2B SaaS company increased conversion rate from SQL to Opportunity by 34% and cut their sales cycle by 21 days just by integrating calculator data into sales process.

If the answer requires interaction, the SERP can’t steal it. You have to use the tool. Reading about a calculator doesn’t help you calculate.

The Job Changed

Old TOFU goal was rank, click, retarget.

New TOFU goal is different.

You shape mental models so your framework is in their head before they’re ready to buy. You do preference formation so your approach feels obvious before they evaluate alternatives. You create distribution assets that travel on their own. You become the “source chunk” AI tools reference.

You design for “SERP-as-feed” not “SERP-as-portal.” Assume most won’t click. Win value without the click. Publish frameworks people quote. Structure content so AI extracts clean chunks.

Don’t scale content. Scale insight production. Google explicitly targets scaled content abuse. Doesn’t matter if AI or humans make it. Use AI for research, outlining, repurposing. But gate output on novel input. Proprietary data. Real examples. Expert review. Actual POV.

Your KPIs need updating too. Lower clicks mean you measure brand search lift. Assisted conversions. Share of conversation across answer surfaces. Newsletter capture. Community growth. Your “organic sessions” dashboard understates influence by a bigger margin every quarter.

The Real Question

HubSpot lost 70-80% of traffic in weeks. They had one of the best SEO teams in the world.

NerdWallet built their entire business on organic search. Brutal quarters.

280 media executives from 51 countries just told Reuters they’re walking away from traditional search. Not pivoting. Walking away.

Here’s what nobody’s saying out loud: most of you reading this are still building the same TOFU you were building two years ago. Same keyword exports. Same content briefs. Same “optimize for volume” approach.

You saw HubSpot’s numbers. You read about Business Insider cutting staff. You nodded at the Reuters data.

And tomorrow you’ll open the same keyword tool and map content to the same metrics that stopped working in May 2024.

The people who survive this aren’t the ones waiting for “best practices” to emerge. They’re the ones who looked at interactive calculators converting at 25-35% and said “we’re building that next week.” Who started publishing original research nobody else has. Who stopped chasing rankings for “what is X” and started building tools people actually need to use.

You don’t need permission. You need to decide whether you’re rebuilding or just rearranging deck chairs while your traffic drops another 33% this year.

The data came out four days ago. What are you doing on this upcoming Monday?

Signing out

Pankaj & Vaishali